Architecture of the SME Compass Index Pillars:

The SME Compass Index 2024 provides a holistic portrayal of SME competitiveness by including a weighted average of 75 distinct indicators. Each of these measures a specific aspect of competitiveness. These indicators are systematically clustered into nine overarching categories or “pillars” of competitiveness. The subsequent dashboard offers a detailed exploration into each specific pillar of the SME Compass Index. The subsequent dashboard offers a detailed exploration of each sector. The subsequent dashboard offers a detailed exploration of each sector.

Interpretation of Results

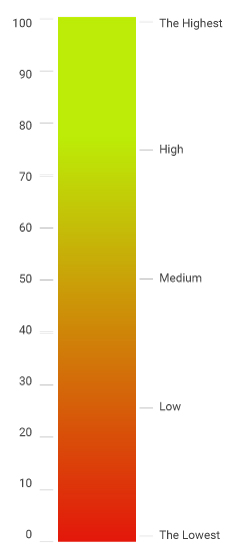

Index results are presented on a scale from 0 to 100.

In the case of phenomena that can have both a positive and a negative side, a value of 50 represents a neutral attitude, 0 a maximum negative, and 100 a maximum positive result.

For phenomena that show the presence or absence of something (technology, program, innovation), a value of 0 indicates the complete absence of the phenomenon/advance, a value of 50 a limited amount of progress, and a value of 100 a large amount of progress/presence.

In other words, Theoretical maximum of 100 would imply the perfect score across SME Compass Index nine pillars, i.e. private sector that is (1) very optimistic and has solid economic performance (on the EU average level), unconstrained by (2) business environment, (3) workforce availability, (8) access to finance; constantly developing (4) it’s business model, (5) industry 4.0 and digitalization and (6) innovation (both to the EU average level); making constant improvements in (7) green transformation; and is (9) gender equitable.

In all cases except Business environment, Business model, Access to finance and Gender Equality, maximum values are determined to resemble the EU averages, using proximate indicators.

In case of gender equality, we opted for the positive gender discrimination, meaning that the value of 100 would mean business economy completely owned / managed and employed by women. In current case, value of 50 shows presents equality.

Brief overview of Pillar scores:

Serbian SMEs particularly stand out in the Business Sentiment and Performance pillar, mainly credited to their optimistic outlook. The scores for Business Model and Human Resources are akin, yet each bears distinct challenges. Although the Serbian workforce receives praises for quality, an emerging labor scarcity remains a concern. On the Business Model front, despite Serbian firms’ notable export orientation signifying their competitiveness, there’s a noticeable inertia in tangible managerial or operational upgrades. This inertia often stems from the underinvestment in SMEs. Such investment shortfalls manifest in relatively weak performances within Innovation, Green Transformation, and Digitalization & Industry 4.0.

Description of Pillars

1st Pillar: Business Sentiment and Performance

This pillar evaluates the collective confidence and historical performance of SMEs, noting that both optimism and past success are foundational for business growth and innovation. A positive business sentiment, supported by tangible performance metrics such as sales growth and profitability, anchors SME competitiveness. The assessment combines both subjective views on market conditions and objective financial data from company records.

2nd Pillar: Business Environment

This pillar examines the range of external factors, from regulations to infrastructure, that influence business operations at the national level. An efficient environment promotes economic growth by attracting investments and fostering innovations, while a challenging one can hinder progress. Indicators, encompassing business rules to public service satisfaction levels, offer a detailed insight into Serbia’s business context.

3rd Pillar: Human Resources:

Focusing on the core of SMEs—their workforce—this pillar evaluates employee skills, availability, and interactions. Acknowledging that skilled and engaged employees are crucial for competitive advantage, the criteria cover both specific skill sets and the quality of workplace relationships. The scope of evaluations includes technical skills, workforce availability, and employee retention challenges, providing a thorough perspective on a company’s workforce capabilities.

4th Pillar: Business Model

This pillar evaluates a company’s strategic approach to maintaining competitive advantage, particularly when traditional methods become unsustainable. It examines whether firms prioritize low costs or deliver differentiated, value-added products. Key factors include e-commerce utilization, customer feedback incorporation, and the balance between domestic and foreign income sources. The pillar also explores constant innovation, product refinement, and market expansion strategies.

5th Pillar: Digitalization and Industry 4.0

This pillar highlights the need for businesses to adopt digital strategies to remain relevant and competitive. Companies slow to digitize risk market irrelevance due to shifting consumer expectations. Emphasis is on cloud computing, social media engagement, automation, and artificial intelligence. The pillar’s indicators measure the depth of a company’s digital transition, from ICT security to software implementation.

6th Pillar: Innovation

This pillar stresses the importance of creativity and novel approaches at both the company and macroeconomic levels. Regions that invest in R&D typically exhibit stronger economic performance. For companies, technological advances drive product and service innovation. This pillar gauges aspects like new process introductions, intellectual property management, and the impact of government policies on business innovation.

7th Pillar: Green Transition

This pillar evaluates a company’s environmental accomplishments and future plans. The European Green Deal sets ambitious sustainability targets, but Serbia lags in its green commitments, particularly in energy and waste management. The ability of businesses to compete on international markets, where strict criteria for recycling, energy efficiency, waste management, and other areas are swiftly being imposed, is becoming more and more dependent on investments in green technologies. Indicators assess regulatory understanding, emissions and waste reduction, and investment in sustainable technologies.

8th Pillar: Access to Finance

This pillar underscores the crucial role of financial resource availability for businesses. Secure access boosts competitiveness by allowing companies to fund operations, technology, and expansion. Key indicators assess the ease and diversity of external financing, emphasizing the potential limitations of over-reliance on internal funds.

9th Pillar: Gender Equality

The Gender Equality pillar delves into workforce gender disparities. Despite some progress, multiple factors contribute to ongoing inequality, including societal norms and economic challenges. The recent financial downturn and the COVID-19 pandemic have further hindered gender equality efforts. Indicators within this pillar focus on female representation in professional roles, company ownership, and managerial positions.